Content Attributes

Landlords rent properties to tenants. Landlords may rent multiple units to various tenants, such as units in an apartment building. Other landlords rent a single property to tenants. Landlords may also lease commercial properties used by businesses.

Whether you’re dealing with one property or multiple units, you should understand the laws governing rental property taxes and how to maximize your deductions. Since everyday landlord expenses include repairs, let’s look at whether you can claim repair costs on your taxes, tax resources you may need, and other expenses you may be able to write off.

Can landlords claim repair costs on their taxes?

Landlords can claim repair bills when filing their taxes. Claiming repair costs enables you to reduce the amount of taxes owed on rental income. Whether you need to replace a leaking roof or hire a plumber to repair water pipes. Those costs can be deducted when you file your taxes.

Since repair costs are tax-deductible, you should maintain structural repairs to prevent further damage and secondary costs. For example, when a building’s heating, ventilation, and air conditioning (HVAC) system is in disrepair. It may work harder than usual to alter the air temperature. Consequently, the energy bills may increase. In some rental situations, the people affected by the increase are the tenants, who may complain. In other cases, landlords pay the utility bills, which means your bills will rise.

Many people don’t understand the benefits of regular HVAC system maintenance. There are many HVAC myths you need to stop believing, such as HVAC systems that are working don’t need maintenance. Maintaining your system will keep energy bills from skyrocketing, and you’ll extend your HVAC unit’s lifespan. Which means you won’t need to have a new system installed prematurely.

HVAC companies offer maintenance agreements and send certified HVAC technicians out twice per year to inspect the unit, replace damaged parts, install a new air filter, and clean the HVAC unit. Routine maintenance also prevents your system from breaking down when it’s needed, helping you avoid costly repairs.

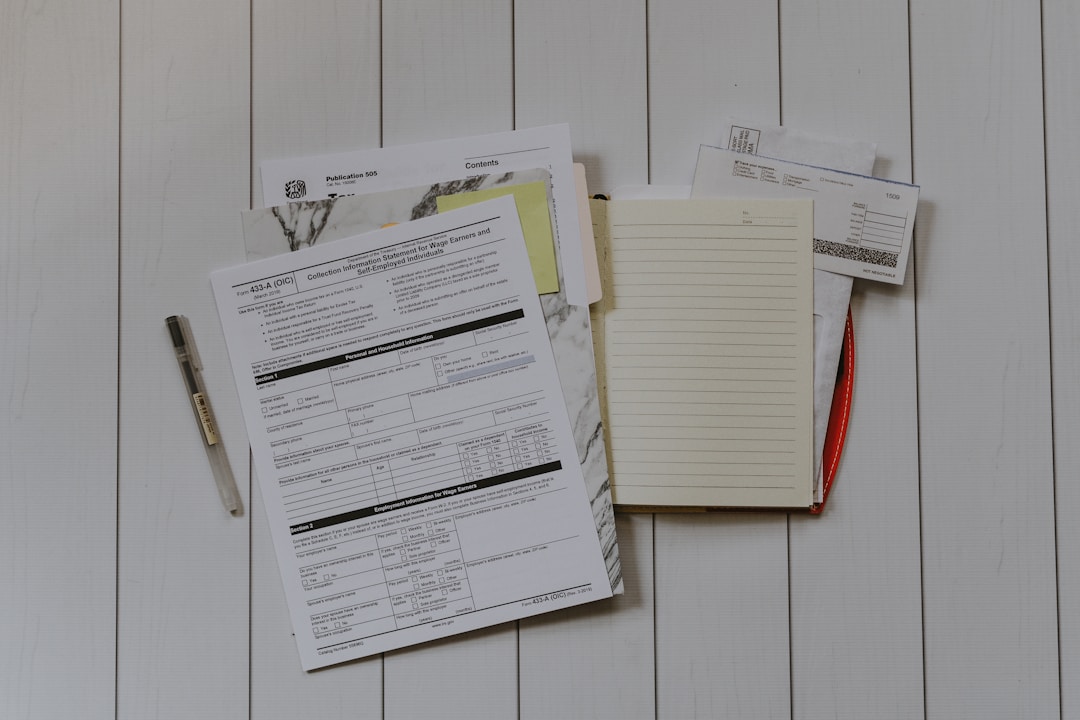

What tax resources do landlords need?

Landlords have a lot of paperwork they must gather to ensure they claim all income and expenses on their taxes. Which is why they benefit from resources such as tax software, tax folders, and tax envelopes. You won’t have to scramble to find documents during tax season if you stay on top of your paperwork.

One way to keep track of your expenses is to use tax envelopes or folders to save receipts. You can have envelopes or folders for revenue and expenses. That haven’t been processed and have other envelopes and folders for items already added to your financial documents.

You’ll also want tax envelopes for submitting your tax documents. Tax envelopes work with specific software programs, ensuring the mailing address and sender’s address appear in the envelope windows, making it easy for you to address and mail your tax returns.

Are there other expenses landlords can write off?

Landlords can write off expenses related to the cost of renting properties. Suppose you have tenants who don’t renew their lease and must advertise for new tenants. The advertising costs and associated costs of securing new tenants. Such as the costs of cleaning and painting, can be written off your taxes.

You may be able to claim extraneous costs such as entertainment costs. If you’re renting commercial properties or negotiating a significant rental agreement. For example, if you’re trying to rent multiple rental homes to a company that needs units for employees. You may opt to meet with the potential clients over lunch or take them golfing to show off local amenities. These expenses are also tax-deductible.

Landlords can write off multiple expenses, including repair costs. Landlords can use tax envelopes and folders to organize their receipts and can claim other costs, such as advertising costs.